You should decide when to deposit your FUTA tax primarily based on the quantity of your tax legal responsibility as determined on a quarterly foundation. If your FUTA tax legal responsibility is $500 or much less in a quarter, then carry it over to the next quarter. If it’s $500 or much less for the fourth quarter, then you can even make a deposit or pay the tax with your Type 940 by Jan. 31.

The following tables show burden estimates based mostly on current statutory requirements as of December 1, 2024, for employers submitting employment tax reporting types and wage statement varieties. Time spent and out-of-pocket prices are presented individually. Time burden is the time spent to adjust to employer reporting duties, together with recordkeeping, preparing and submitting types, and getting ready and offering wage statements to employees. Out-of-pocket costs embody any bills incurred to adjust to employer reporting duties. The quantity of taxes paid isn’t included in reporting burden.

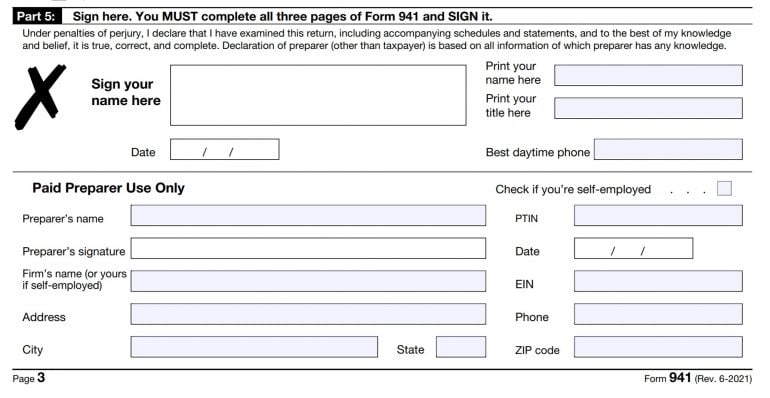

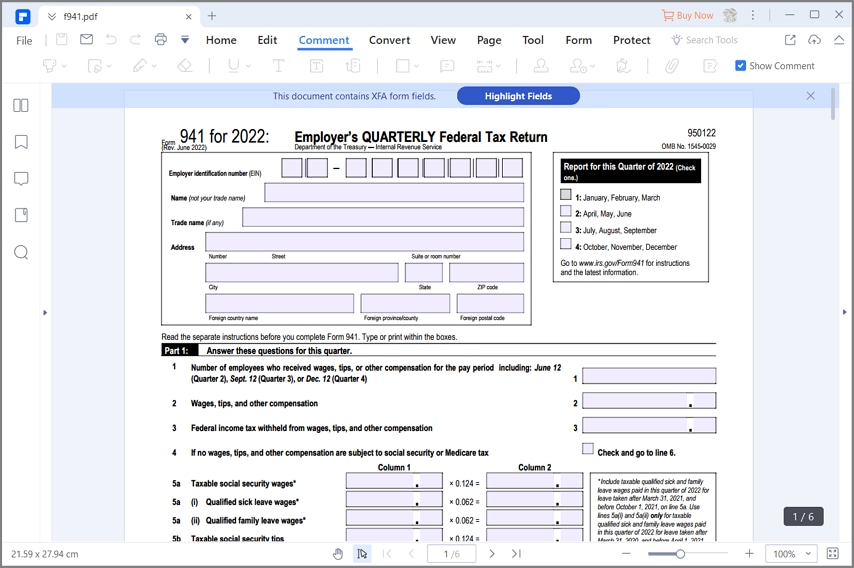

What If You Sold Your Corporation

These instructions provide you with some background details about Kind 941. They tell you who must file Kind 941, tips on how to complete it line by line, and when and the place to file it. If you employ a paid preparer to complete Kind 941, the paid preparer must complete and signal the paid preparer’s part of the shape. For the most recent details about developments related to Type 941 and its instructions, such as laws enacted after they have been revealed, go to IRS.gov/Form941. A private supply service (PDS) will help guarantee your return will get to the IRS on time. PDS deliveries should solely be sent to considered one of these IRS addresses.

Report Wages And Taxes

Thomson Reuters can also help you shortly discover professional solutions with CoCounsel Tax. The following TurboTax Online offers could also be out there for tax yr 2024. Intuit reserves the best to modify or terminate any supply at any time for any cause in its sole discretion. Until in any other case stated, each supply just isn’t obtainable together with any other TurboTax presents.

For extra info on the different types of third-party payer preparations, see section sixteen of Pub. Typically, employers must report wages, suggestions and different compensation paid to an employee by submitting the required Form 941, Employer’s Quarterly Federal Tax Return. Most employers must additionally file Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, to report the wages paid subject to FUTA, and to compute the tax. All employment taxes, including FUTA, have to be deposited timely and by the required methodology. Enter the federal earnings tax you withheld (or had been required to withhold) from your workers on this quarter’s wages, suggestions, taxable fringe advantages, and supplemental unemployment compensation advantages. Don’t embrace any income tax withheld by a third-party payer of sick pay even should you reported it on Varieties W-2.

- If you made semi-weekly deposits, full Schedule B to Kind 941.

- Prior revisions of Kind 941 are available at IRS.gov/Form941 (select the hyperlink for “All Type 941 revisions” under “Other objects you could find useful”).

- Enter the outcome in the “Total legal responsibility for quarter” box.

- This material has been prepared for informational functions solely, and isn’t supposed to offer or be relied on for tax, accounting, or legal advice.

To use the same-day wire fee method, you’ll need to make preparations with your monetary institution ahead of time. Please examine together with your financial institution relating to availability, deadlines, and prices. Your financial establishment may charge you a fee for payments made this fashion. To learn more in regards to the information you’ll need to give your financial institution to make a same-day wire fee, go to IRS.gov/SameDayWire. Many forms and instructions discussed in these directions have Spanish-language versions out there for employers and staff.

Everyone who’s engaged in a commerce or business that makes certain types of reportable funds should report the payment to the IRS. Type 1099-NEC, Nonemployee Compensation, is used for reporting payments for non-employee compensation that total or exceed the reportable payment threshold quantity made to a payee. Kind 1099-MISC, Miscellaneous Information, or another kind of information return is used for reporting funds other than non-employee compensation. The IRS is permitting businesses to defer payment of certain employment taxes as a half of two tax credit launched during the 2020 COVID-19 pandemic.

Workers might submit a written assertion or digital tip document. If no wages, ideas, and other compensation on line 2 are topic to social security or Medicare tax, examine the box on line 4. If this question doesn’t apply to you, leave the field blank. For more details about exempt wages, see part 15 of Pub. Then, you must file for each quarter after that—every three months—even when you have no taxes to report, except you’re a seasonal employer or are filing your ultimate return.

You’re required to begin withholding Extra Medicare Tax within the pay interval during which you pay wages in extra of $200,000 to an worker and continue to withhold it each pay interval until the end of the calendar 12 months. Additional Medicare Tax is just imposed on the employee. All wages that are topic to Medicare tax are topic https://www.intuit-payroll.org/ to Extra Medicare Tax withholding if paid in extra of the $200,000 withholding threshold.

Tax And Employment Compliance, Handled For You

By guaranteeing correct reporting and serving to you remain compliant with related tax legal guidelines, we minimize the chance of expensive penalties and compliance issues. Book a demo to learn how our team can handle the heavy-lifting of global compliance, so you’ll have the ability to concentrate on scaling your small business. If you’re a paid preparer, enter your Preparer Tax Identification Number (PTIN) within the house provided. If you work for a firm, enter the agency’s name and the EIN of the agency.